Less than 25% of the Japanese population own a passport, and even among the younger generation outbound travel has dropped significantly since its peak in the late 1990s and early 2000s. It is perhaps unsurprising that they then understand the tropes and perceptions of other nations in a very distinctive and sometimes limited way. This is a real challenge for foreign brands which would otherwise safely assume that their products’ packaging speaks volumes about origins and quality to global consumers.

It is apparent in Japanese supermarkets that imagery used to indicate national origin as a marker of quality is rare and, when used, extremely simple. So wine, cheese and olive oil all carry a neat Italian or French flag, but pictures of the Swiss Alps are not automatically associated with chocolate. Foreign brands have learned to use a reduced visual vocabulary when attempting to leverage their national origin.

Danone’s Oikos (home) Greek yoghurt demonstrates the response. In any other country, its packaging would suggest not only its Greek origins but the benefits of its association with the famous Mediterranean diet. But on the Japanese version of the product, none of this imagery exists: no temple columns, no classical lettering. Instead the logo is in a plain sans-serif font, and the only message is about high protein content. This is sensible marketing: the health benefits of yoghurt are well known to the Japanese: that of the Mediterranean diet less so. Any association with Greekness would not help the product compete: it would simply appear to be a quaint curiosity.

Competition within the F&B sector is further stymied by Japanese brands already dominating the ‘national origins’ marketing strategy: think of a food, and Japan has a region that specializes in it. Milk is from Hokkaido, apples from Aomori, peanuts from Chiba, mango from Miyazaki, and citrus fruits from Kōchi. This is an impossible contest to win: the term kokusan (国産) or ‘domestically-produced’ is the highest indicator of quality for any Japanese consumer. Not even the most exclusive European cheeses entirely retain their advantage when standing next to a clear knock-off made from Japanese ingredients.

Left: Mozarella with Italian colour scheme but clearly stating “Made with 100% Milk from Hokkaido”

Right: “Made in Japan” is still best, even if it’s inspired by France

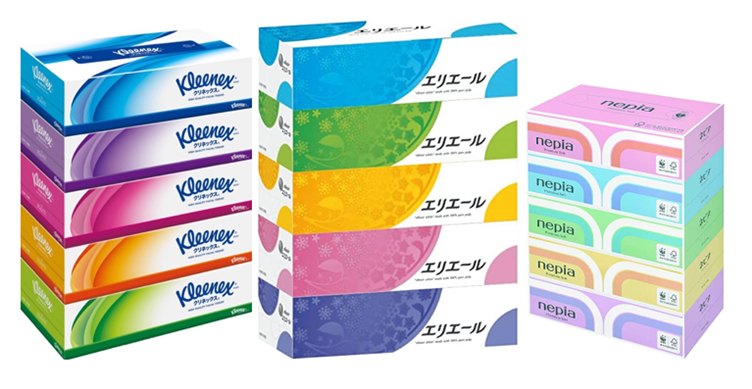

The problem can get worse: foreignness can be a distinct negative. Understanding the nuances meticulously is essential. In most of the world, the U.S. is perceived as innovative. However, here its products can be seen as slightly zatsu (雑) or ‘crude’: not as delicate as, say, products of Japanese origin. It is telling to look at Kleenex, an iconic and venerable brand. By choosing to mimic the design of typical Japanese tissue packaging rather than promoting its American origins and past, it has been able to compete successfully in a category where ultimate softness is required and where it might otherwise have easily failed.

Above: Japanese Kleenex packaging next to domestic tissue brands

All this said, there are moments when foreignness works very well. France is seen in Japan as the epitome of sophistication and chic: an asset for the beauty industry in particular. As a result, brands such as l’Occitane have been able to retain their visual look and product lineup. Consumers may not be familiar with Provencal lavender fields, but Frenchness has a value to them. Its foreign landscapes and aesthetics work not as something other, but as something inspiring.

The German company Kneipp is another beauty brand that leverages its national origin successfully. In Japan, the packaging design of its series of herbal bath salts is strongly medicinal in tone, and the website contains an in-depth dictionary of herbal ingredients. Meanwhile, in Germany the brand instead shows herbs as promoting relaxation and mindfulness, and its homepage offers advice on self-care. The contrasting approach makes sense: Japanese medicine has long been so influenced by German medicine that many German loan words are still used today. It is a deep association that naturally makes the product credible.

What then is the answer for foreign brands navigating these waters, who find that the nuances surrounding their origins are not always obvious? How do they respond to Japanese consumers making certain associations that can be hard to fathom, and that may lose or gain traction depending on circumstances and classification? Ultimately, for those without a handle on cultural preconceptions, Japan can prove a complex and bewildering market in which the national origin and qualities of a product may need to be expressed very differently to succeed.

[1] See e.g. https://www.mofa.go.jp/mofaj/files/100005171.pdf for government statistics on the number of issued passports.